Nvidia Deepens AI Infrastructure Bet With CoreWeave Investment

Nvidia is tightening its grip on the physical backbone of the artificial intelligence economy, investing US$2 billion into AI infrastructure provider CoreWeave as demand for large scale computing capacity continues to accelerate. The investment makes Nvidia the company’s second largest shareholder and expands a partnership centered on rapidly scaling US based data center capacity. Rather than focusing on application level innovation, the move underscores Nvidia’s strategic emphasis on ensuring that downstream infrastructure can absorb the growing volume of AI workloads built around its hardware ecosystem. As enterprise adoption widens, access to land, power, and grid connectivity has become as critical as chip availability, turning infrastructure providers into key choke points in the AI value chain.

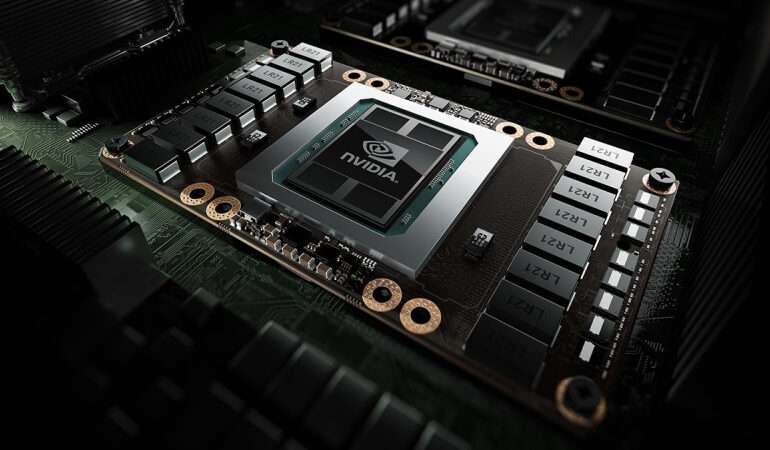

CoreWeave represents a new class of so called neocloud operators that specialize in high density AI compute rather than general purpose cloud services. Originally a cryptocurrency miner, the company has repurposed its infrastructure to lease Nvidia GPUs to technology firms developing and deploying AI systems. The latest funding is earmarked for expanding physical capacity rather than purchasing additional processors, highlighting that bottlenecks are increasingly structural rather than silicon based. CoreWeave is targeting more than five gigawatts of AI data center capacity by the end of the decade, an ambition that reflects how rapidly compute requirements are scaling. Nvidia’s deeper equity position suggests confidence that specialized infrastructure providers will remain central to the AI build out rather than being fully absorbed by hyperscale cloud incumbents.

The investment also illustrates Nvidia’s evolving role beyond chip manufacturing. By taking significant stakes across the AI ecosystem, the company is positioning itself as both a technology supplier and a capital allocator shaping industry structure. This strategy has drawn scrutiny from investors concerned about circular financing, where Nvidia capital indirectly supports demand for its own products. While CoreWeave has stated that the funds will not be used to purchase Nvidia hardware, the alignment remains clear. Nvidia benefits when AI infrastructure expands, regardless of whether it directly finances chip purchases. The approach reflects a belief that securing long term demand requires active participation in solving systemic constraints rather than relying solely on product leadership.

At a broader level, the deal highlights how AI competition is shifting from model development toward infrastructure control. Power availability, permitting timelines, and grid access are emerging as decisive factors in determining where and how fast AI capacity can scale. Nvidia’s partnership with CoreWeave signals an understanding that the next phase of AI growth will be governed less by algorithmic breakthroughs and more by industrial execution. By anchoring itself deeper in the infrastructure layer, Nvidia is reinforcing its influence over how AI ecosystems expand, a strategy that could shape competitive dynamics well beyond the current investment cycle.