ASML Flags Slowing China Demand Under Sanctions Pressure

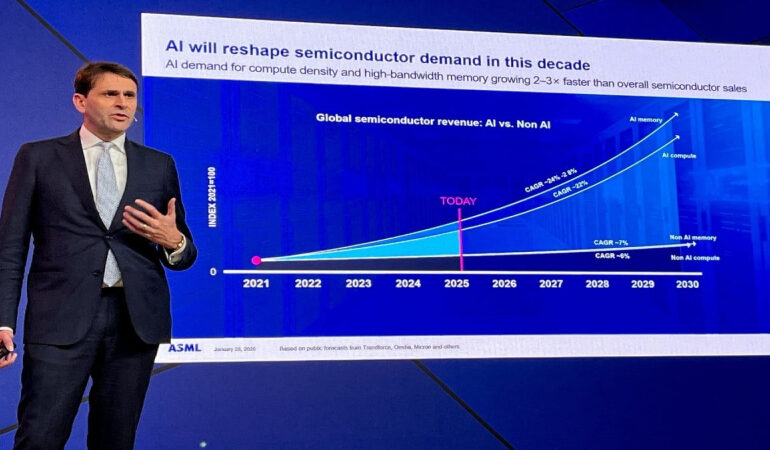

Global demand for semiconductor manufacturing equipment remained strong in 2025, but China is no longer the growth engine it once was for Europe’s largest chipmaking tools supplier. After a year of double digit sales growth, ASML signaled that its already declining exposure to China is set to shrink further as US led trade restrictions continue to limit shipments of advanced machines. Company executives said demand from other regions stayed robust, driven by capacity expansion in logic and memory chips tied to artificial intelligence and high performance computing. In contrast, China’s role in ASML’s sales mix is fading as customers adjust to a tighter export environment and earlier stockpiling effects begin to wear off, reshaping the balance of global semiconductor investment.

China’s share of ASML’s total revenue fell sharply last year and is expected to drop again in 2026 as access to cutting edge lithography tools remains restricted. While Chinese buyers can still purchase less advanced deep ultraviolet systems, demand for these machines has weakened following an earlier surge in orders. That rush was triggered by a reopening of the Chinese economy and efforts by chipmakers to secure equipment before controls tightened further. With much of that pent up demand now satisfied, ASML expects a normalization phase that will weigh on Chinese sales even as overall global demand stays elevated. For Beijing’s semiconductor ambitions, the slowdown highlights how export controls are biting beyond the most advanced nodes.

The shift underscores a broader realignment in the global chip supply chain. ASML’s strongest growth momentum is increasingly concentrated in regions aligned with US technology policy, where massive investments are underway to expand domestic chip production. New fabs in North America, Europe, and parts of Asia are driving orders for advanced equipment as governments subsidize local manufacturing to secure supply chains. China, by contrast, is being pushed toward a more inward focused development path, relying on existing tools and domestic innovation to advance its semiconductor capabilities. This divergence is reinforcing a bifurcated industry structure, with separate technology trajectories emerging under geopolitical pressure.

For ASML, the changing China outlook reflects strategic risk management rather than a collapse in global demand. The company continues to benefit from strong pricing power and long term visibility tied to the AI driven chip cycle. However, the decline in China sales highlights how political constraints can override market forces even in capital intensive industries. For China Crunch watchers, the message is clear. China remains a major semiconductor market, but its access to the world’s most advanced production technology is narrowing. As sanctions persist, China’s share of global chip equipment demand is likely to continue falling, reshaping both its industrial strategy and the global balance of semiconductor power.