Tesla’s AI Pivot Pushes Chinese EV Makers to Broaden Tech Ambitions

China’s leading electric vehicle makers are accelerating their shift beyond cars as the evolving strategy of Tesla reshapes competitive pressure across the mainland auto market. Despite slowing deliveries and tighter margins in China, Tesla’s repositioning as an artificial intelligence driven company has had a catalytic effect on domestic rivals rather than dampening ambition. Companies once framed simply as electric car manufacturers are now expanding into broader technology platforms, betting that intelligence, automation, and vertical integration will define the future of mobility. The trend reflects how competition with Tesla is no longer centred only on vehicle sales, but on the ability to control software, data, and advanced systems that extend well beyond traditional transport.

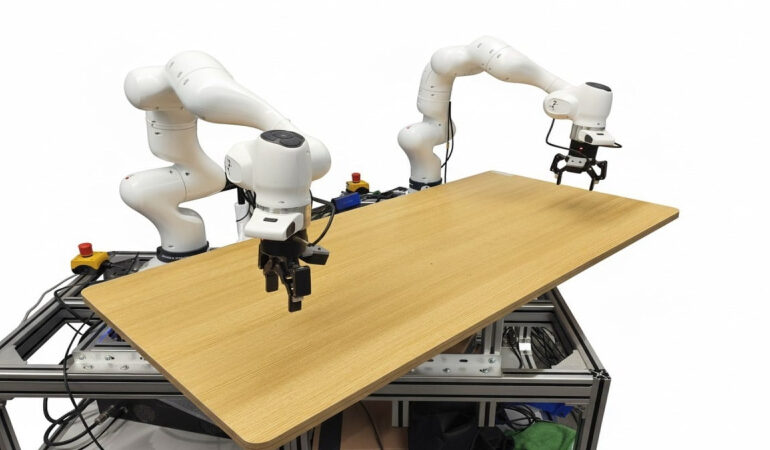

Manufacturers including Xpeng, Li Auto and Nio have begun repositioning themselves as technology ecosystems rather than standalone automakers. These firms are investing heavily in autonomous driving software, artificial intelligence research, and next generation hardware, while also branching into adjacent fields such as robotics and aviation. Xpeng has showcased flying car concepts alongside its smart vehicle platforms, while others are developing in house chips and operating systems to reduce reliance on external suppliers. The aim is to create tightly integrated stacks that mirror Tesla’s model, but adapted to China’s regulatory environment and consumer preferences.

This diversification push comes as the domestic EV market matures and price competition intensifies, squeezing margins and forcing companies to seek new growth narratives. By expanding into AI powered mobility, urban air transport, and intelligent machines, Chinese EV makers are positioning themselves for a longer term transformation of transport rather than a single product cycle. These moves also align with Beijing’s broader industrial priorities, which encourage high value manufacturing and indigenous technology development. While many of these projects remain at early stages, companies view them as strategic investments that could define competitiveness over the next decade as mobility converges with computing and automation.

The shift highlights how Tesla’s influence in China extends beyond market share to strategic direction. Even as its sales momentum softens, its emphasis on AI, software and vertical integration continues to shape industry thinking. Chinese rivals are effectively racing to prove they can match or surpass that vision by embedding intelligence across vehicles and related platforms. The outcome will determine whether they can move from being fast followers in electric cars to leaders in the next phase of smart transportation, where value is increasingly generated by algorithms, data and ecosystem control rather than hardware alone.