AI and Digital Yuan Integration: How China Is Building the Future of Smart Finance

China’s rapid progress in artificial intelligence and digital finance is converging into a new ecosystem where AI and the digital yuan (e-CNY) operate as the twin engines of a data-driven economy. At the center of this transformation is the integration of intelligent algorithms with financial infrastructure, enabling faster payments, smarter credit systems, and more secure settlements. This strategy reflects Beijing’s broader ambition to modernize its monetary system while strengthening the technological foundations of national finance.

The Evolution of AI in China’s Financial Sector

Over the past decade, Chinese fintech giants have leveraged AI to process trillions of transactions, detect fraud, and improve risk management. What began as an experiment in digital payments through Alipay and WeChat Pay has now evolved into a state-backed digital currency framework that uses AI for transaction analysis and compliance automation. The People’s Bank of China (PBoC) is deploying machine-learning systems to track anomalies in e-CNY transactions and prevent illicit activities without compromising speed or user convenience.

Banks such as ICBC and Bank of China are also integrating AI-driven credit assessment tools, replacing traditional collateral checks with behavioral analytics. This AI-finance synergy allows real-time loan approvals, dynamic interest rates, and predictive liquidity management. For small businesses, it means faster access to capital and reduced operational friction.

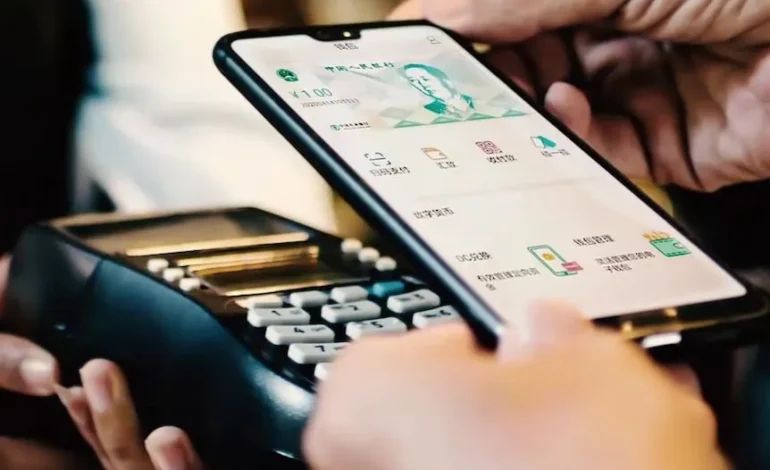

The Digital Yuan as a Smart Payment Infrastructure

The digital yuan has already processed over 1.8 trillion yuan in transactions across pilot regions, and its integration with AI is turning it into more than just a digital form of cash. Intelligent settlement systems are now using neural network models to predict optimal transaction routes, reducing latency and improving cross-border efficiency.

In trade zones such as Shenzhen and Shanghai, AI-powered clearing systems enable instant settlements between exporters and importers. Smart contracts, operating within the digital yuan architecture, automatically execute payments upon fulfillment of delivery milestones, eliminating manual verification and third-party delays. This not only reduces transaction costs but also strengthens transparency and trust in cross-border trade.

AI-Driven Regulation and Financial Transparency

One of Beijing’s strategic priorities is ensuring that AI-powered finance aligns with national regulatory principles. The AI Financial Compliance Center, launched in 2025, oversees algorithmic fairness, data usage, and risk governance for digital currency applications. The system automatically flags suspicious activity and recommends corrective action to financial institutions in real time.

This model of machine-supervised finance enhances both efficiency and accountability. Unlike traditional oversight, which relies on periodic audits, AI provides continuous monitoring of every transaction flow. The outcome is a financial environment where compliance is embedded directly into infrastructure rather than imposed externally.

Implications for Global Digital Finance

China’s approach to integrating AI with its digital currency system could influence how future financial infrastructures evolve worldwide. As nations from the Middle East to Southeast Asia explore central bank digital currencies, many are studying the Chinese blueprint for intelligent monetary ecosystems. Partnerships between Chinese fintech firms and foreign central banks are already testing interoperability frameworks that connect local digital currencies to the e-CNY network.

This development has profound implications for trade settlement and monetary sovereignty. By exporting AI-enhanced payment technologies, China is setting the groundwork for a multipolar digital currency system, where speed, security, and data intelligence define competitiveness more than legacy banking networks.

Conclusion

The fusion of AI and digital currency marks a turning point in China’s financial modernization. Through smart algorithms, predictive analytics, and automated compliance, the country is building a transparent and efficient system that could become a global model for digital finance. As the world moves toward intelligent economies, China’s experiment with AI-integrated payments demonstrates how technology can reshape not just how people pay, but how nations manage money itself.