Goldman Sachs Warns Brazil Must Maintain Fiscal Discipline After 2026 Election

Global investment bank Goldman Sachs has cautioned that Brazil’s long-term economic stability will depend heavily on the government’s commitment to fiscal discipline after the 2026 elections. The warning comes amid rising public spending, political uncertainty, and pressure to sustain growth in Latin America’s largest economy.

In a new report released this week, Goldman Sachs analysts said that while Brazil’s short-term outlook remains steady, fiscal policy risks could resurface once the current administration’s term ends. “The next government will face the crucial task of maintaining credible fiscal management,” the report stated. “Without it, Brazil could see a return of market volatility, higher borrowing costs, and a loss of investor confidence.”

Over the past year, Brazil’s economy has shown resilience thanks to strong commodity exports, steady employment, and growing consumer demand. However, spending pressures have increased as the government expands social programs and public investment ahead of the next election cycle. Economists warn that these measures, though politically popular, may threaten the country’s fiscal balance if not offset by higher revenues or spending reforms.

Goldman Sachs pointed to Brazil’s new fiscal framework, which was introduced to replace the former spending cap rule. The framework aims to limit annual growth in government spending while tying it to revenue performance. According to the bank, the credibility of this mechanism will depend on whether future administrations adhere to its guidelines and resist populist temptations.

“Fiscal credibility is not built overnight,” said Alberto Ramos, Goldman Sachs’ head of Latin America research. “The post-election environment will be critical. A clear commitment to balanced budgets, predictable policies, and institutional discipline will determine whether Brazil can sustain investor confidence.”

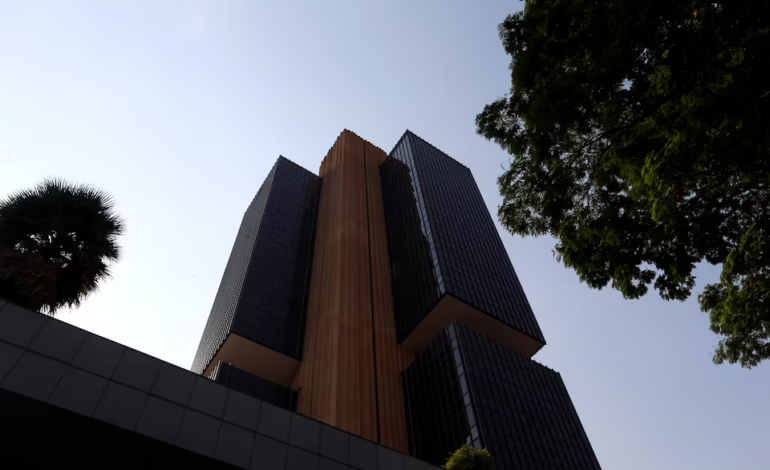

The report also noted that Brazil’s central bank has maintained a cautious approach to interest rate cuts, reflecting concerns over inflationary pressures. Analysts said that stable inflation, combined with fiscal responsibility, would help the country achieve more durable economic growth.

Foreign investors have long viewed Brazil as a key emerging market, but recurring episodes of fiscal slippage and political instability have often shaken confidence. With public debt hovering around 75 percent of GDP, maintaining control over government finances will be essential to prevent rating downgrades and currency depreciation.

Economists say the next administration will need to focus on tax reform, improved public sector efficiency, and credible deficit reduction measures. “Fiscal discipline is the foundation for sustainable development,” Ramos added. “If Brazil can maintain that focus after 2026, it will remain one of the most attractive markets in the region