Broadcom’s Momentum Surges as Wall Street Rallies Behind the ChipmakerBroadcom’s Stock Keeps Climbing

Broadcom is having a standout moment in the semiconductor world with investors showing overwhelming confidence as the company fires on all cylinders. The stock has been climbing steadily fueled by strong demand for its products strategic expansion in artificial intelligence infrastructure and growing optimism across Wall Street. Analysts say Broadcom has positioned itself at the center of a booming tech cycle one driven by cloud computing data centers and next generation connectivity.

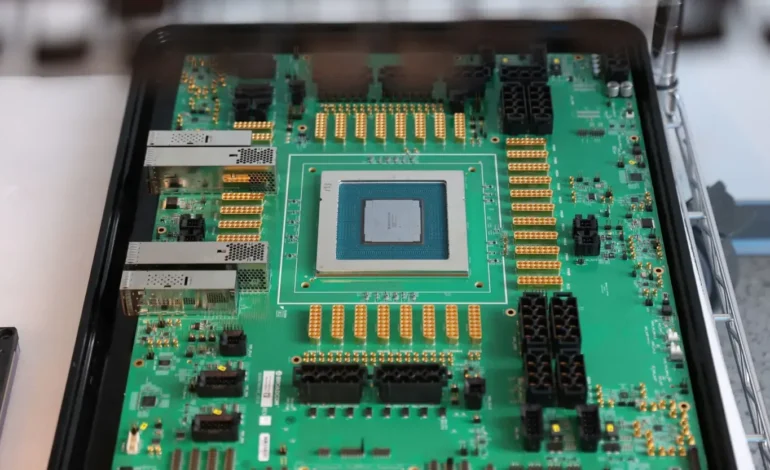

A Strategic Push Into Optical Chip Technology

Recent attention has focused on Broadcom’s efforts to roll out optical chip technology designed to compete directly with Nvidia in the high performance AI market. During a recent lab tour in San Jose Broadcom showcased its new optical advancements highlighting how the company plans to support the massive bandwidth and energy needs of AI training systems. These innovations aim to improve data transfer speeds and reduce transmission bottlenecks critical challenges for tech companies scaling AI workloads. The demonstrations have impressed analysts who now see Broadcom as a credible player in segments previously dominated by competitors.

Financial Performance That Outpaces Expectations

Broadcom’s recent earnings have repeatedly exceeded forecasts demonstrating how effectively the company has managed rising demand for semiconductors across multiple sectors. Its diversified portfolio including networking processors custom silicon and software solutions gives Broadcom an advantage when one segment softens. Investors are particularly encouraged by the company’s steady margins strong cash flow and disciplined capital allocation. These factors have helped sustain momentum even in a volatile market.

AI Demand Continues to Drive Growth

The broader AI wave is powering much of Broadcom’s success. Cloud providers and enterprise customers are investing heavily in infrastructure capable of training and deploying advanced AI models. Broadcom supplies many of the foundational components needed for this shift including network chips and custom accelerators. As companies race to expand their AI capabilities demand for Broadcom’s hardware continues to ramp up. Analysts expect this trend to continue into next year as AI permeates industries from healthcare to finance.

Wall Street Analysts Are All In

Major financial institutions have been consistently raising their price targets on Broadcom’s stock. Analysts cite the company’s strong execution rapid innovations in chip design and a growing list of major clients relying on Broadcom for AI and networking solutions. Several firms now list Broadcom as one of their top picks in the tech sector arguing that its mix of software revenue and semiconductor leadership gives it a long runway for growth.

A Bullish Outlook Despite Competition

Even with stiff competition from Nvidia Qualcomm and others Broadcom’s strategy appears well aligned with the future of computing. Its investments in optical networking custom chip design and software ecosystems position the company to capture a sizable share of the multi trillion dollar AI economy. While challenges remain including supply chain uncertainties and geopolitical risks analysts overwhelmingly agree that Broadcom is on a strong upward trajectory. If current trends hold the chipmaker could become one of the defining winners of the AI hardware race.