The Strategic Logic Behind China’s Fintech Regulation Over the Past Decade

Regulation as a Long Term Strategy

Over the past decade, fintech regulation in China has followed a strategic logic shaped by scale, risk awareness, and institutional learning. Rather than reacting to individual market events, regulators have gradually built a framework that evolves alongside technology adoption. This approach reflects an understanding that when financial tools become foundational to economic activity, regulation must anticipate systemic effects rather than simply respond to disruptions.

Early Tolerance and Learning

In the early years of fintech expansion, regulatory tolerance allowed innovation to flourish. Mobile payments, online lending, and digital platforms scaled rapidly, delivering efficiency and inclusion. This period functioned as a learning phase, enabling regulators to observe market behavior, identify risks, and understand how digital finance interacted with traditional institutions. The absence of heavy intervention supported experimentation while generating data and experience for future governance.

Identifying Systemic Risk

As fintech penetration deepened, risks became more visible. Concentration of market power, uneven data practices, and liquidity exposure raised concerns about stability. Regulators began to recognize that fintech was no longer peripheral. It had become central to payment flows, consumer finance, and business operations. This realization marked a turning point, shifting regulatory focus from innovation enablement to system protection.

Phased Regulatory Adjustment

China’s regulatory response unfolded in phases rather than abrupt shifts. Licensing requirements were clarified, capital standards were strengthened, and data governance gained prominence. Each adjustment addressed specific vulnerabilities while preserving room for innovation. This phased approach reduced market shock and allowed firms time to adapt, reinforcing predictability and confidence.

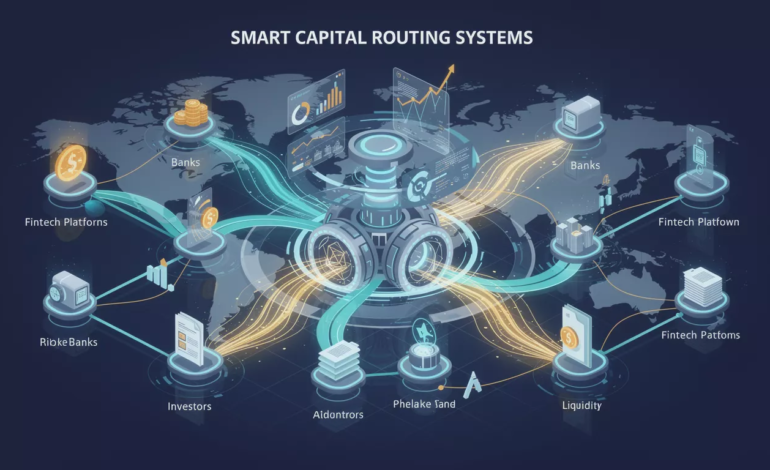

Aligning Fintech With Financial Architecture

A core element of regulatory logic has been alignment. Fintech activities are increasingly integrated into the broader financial architecture, operating alongside banks and regulated institutions. This integration enhances transparency and accountability while reducing fragmentation. By embedding fintech within formal systems, regulation supports stability without dismantling technological progress.

Incentives for Responsible Growth

Regulatory design has also reshaped incentives. Firms are encouraged to pursue responsible growth through compliance, governance quality, and risk management. Success is measured less by speed and more by reliability and contribution to system health. These incentives promote long term thinking and discourage practices that could undermine trust.

Data Governance as a Cornerstone

Data has emerged as a cornerstone of fintech regulation. As decision making becomes more data driven, rules around data use, security, and accountability are essential. Structured governance reduces systemic vulnerability and supports fair competition. Over time, this focus on data has strengthened the foundation of digital finance.

Strategic Outcomes

The strategic logic behind China’s fintech regulation has produced a more coordinated and resilient ecosystem. By balancing experimentation with discipline, regulation has guided fintech from rapid expansion toward institutional maturity. This decade long evolution demonstrates how governance can shape technology sectors in ways that support both innovation and stability.