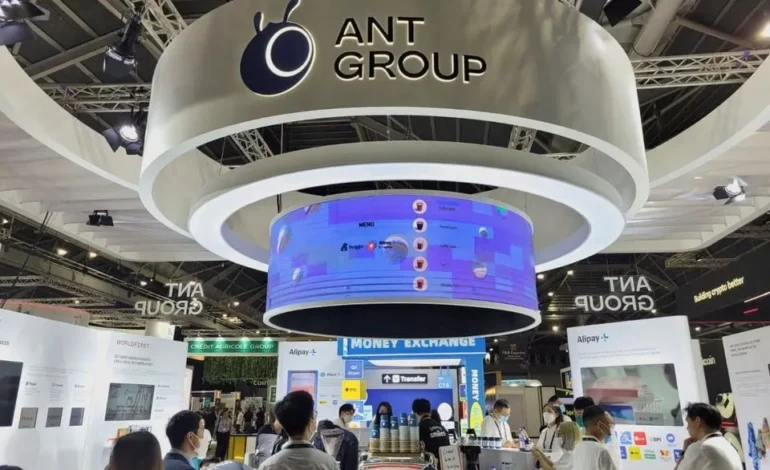

Ant Group Pilots Blockchain Payment System in Second-Tier Cities

Ant Group, one of China’s leading fintech innovators, has launched a landmark pilot program integrating blockchain technology into its digital payment infrastructure. The initiative, rolled out across multiple second-tier Chinese cities including Hefei, Nanchang, and Changsha, aims to improve the efficiency, transparency, and security of financial transactions. Beyond technological advancement, the project also represents a strategic step toward promoting digital inclusion and expanding fintech accessibility beyond major urban centers such as Beijing, Shanghai, and Shenzhen.

This blockchain-based payment pilot underscores Ant Group’s long-term vision of combining fintech innovation with inclusive economic growth. By merging blockchain technology with its already popular digital wallet ecosystem, the company is creating a payment framework that could redefine the standards of transaction verification, risk management, and regulatory compliance in China’s digital economy.

Integrating Blockchain with Digital Payment Systems

At the heart of Ant Group’s new initiative is the integration of blockchain into its existing digital wallet platforms, including Alipay and its affiliated merchant services. The pilot allows both consumers and businesses to process payments on a distributed ledger network, eliminating intermediaries and reducing manual reconciliation errors.

Using blockchain’s immutable data architecture, each transaction is recorded in real time across multiple nodes, ensuring transparency and resistance to tampering. Smart contracts self-executing agreements coded into the blockchain automate verification processes, reducing human error and administrative overhead. This automation accelerates settlement times while ensuring that every step of a transaction is traceable and verifiable.

Preliminary results from the pilot indicate that settlements now occur in seconds rather than minutes, and administrative costs for merchants have fallen by nearly 30 percent compared to conventional digital payment systems. This improvement in operational efficiency highlights how blockchain can optimize financial infrastructure without sacrificing regulatory compliance or user experience.

Local Government Collaboration and Regulatory Oversight

The success of Ant Group’s pilot owes much to strong cooperation between local governments and the fintech industry. Authorities in Hefei, Nanchang, and Changsha have provided technical and regulatory support, ensuring that blockchain deployment aligns with national financial security and consumer protection frameworks.

These cities were chosen deliberately for their growing economies and diverse commercial ecosystems. Each offers a unique testing ground for blockchain’s scalability and adaptability. For example, Hefei’s strong manufacturing sector benefits from blockchain-based supply chain tracking, while Changsha’s expanding retail market provides opportunities for consumer-facing payment solutions.

Local regulators are also using this pilot to monitor how distributed ledger technology interacts with data privacy, financial risk, and anti-money-laundering protocols. The collaboration between Ant Group and municipal authorities ensures that innovation progresses within a structured compliance framework an approach consistent with China’s broader fintech governance model emphasizing “innovation with control.”

Enhancing Efficiency, Security, and Trust

Blockchain’s core advantage lies in its ability to provide real-time visibility and auditability of transactions. Each payment processed through the system is encrypted, timestamped, and permanently recorded, creating an immutable trail accessible to authorized participants.

This transparency drastically reduces the risk of fraud and double spending, which are common vulnerabilities in conventional digital payment systems. In addition, the distributed nature of blockchain ensures that no single entity controls the ledger, improving resilience against cyberattacks or data breaches.

For consumers, the system enhances confidence in digital transactions. Merchants and users can verify transaction authenticity instantly, reducing disputes and chargeback incidents. The increased trust in digital payment systems is particularly significant for small businesses and rural users, many of whom have historically faced challenges related to transaction verification and delayed settlements.

Driving Financial Inclusion Beyond Tier-One Cities

One of the most important aspects of Ant Group’s blockchain pilot is its emphasis on expanding financial access in China’s second-tier cities. While fintech adoption in major metropolitan areas is nearly universal, smaller cities still face digital and infrastructural gaps.

By targeting urban centers such as Hefei, Nanchang, and Changsha, Ant Group is promoting equal access to advanced financial tools. The program enables local merchants, service providers, and individual users to process payments securely and efficiently without relying on costly banking infrastructure.

For small and micro businesses, blockchain-enabled payments simplify record-keeping and accounting. Transactions are automatically logged and categorized, providing business owners with real-time cash flow insights. This transparency helps them qualify for loans, credit lines, and other financial services that require verified transaction histories.

For consumers, integration with Alipay ensures that adoption remains simple and familiar. Users can continue using existing mobile wallets while benefiting from blockchain’s enhanced security and reliability. This seamless interface between legacy fintech platforms and emerging technologies makes it easier for ordinary citizens to transition into a more advanced digital financial environment.

Smart Contracts and Automation in the Real Economy

A key innovation in the pilot program is the use of smart contracts, which automate business logic and enforce predefined rules within the payment process. These programmable contracts execute automatically when specific conditions are met such as confirming delivery of goods or verifying service completion eliminating the need for manual intervention.

In retail, smart contracts ensure instant settlement once a sale is confirmed, reducing processing time and administrative costs. In logistics, blockchain’s immutable recordkeeping allows suppliers, distributors, and retailers to synchronize financial and inventory data in real time. For example, when a shipment reaches its destination, the payment can be automatically released to the supplier, streamlining supply chain efficiency and reducing disputes.

By digitizing these interactions, Ant Group’s system improves cash flow predictability for businesses and reduces the risk of delayed payments an issue that often constrains smaller enterprises in traditional financial systems.

Synergy Between Blockchain and Artificial Intelligence

Ant Group is also integrating artificial intelligence into the blockchain pilot to enhance data analysis and decision-making. AI-driven analytics process transaction data in real time, identifying spending patterns, predicting sales trends, and optimizing inventory management for small merchants.

These AI-powered insights help businesses tailor promotions and improve customer engagement. For instance, restaurants using blockchain-enabled payment terminals can analyze daily purchasing behavior to adjust menu pricing or supply orders. Combined with blockchain’s secure data-sharing features, these capabilities support data-driven growth for local enterprises without compromising privacy or security.

Implications for National Digital Finance Strategy

The blockchain pilot aligns with China’s broader vision of building a smart and inclusive digital economy. It complements ongoing initiatives by the People’s Bank of China (PBoC) and other financial regulators to integrate emerging technologies into the country’s payment infrastructure.

The project also parallels developments in China’s digital yuan (e-CNY) framework, where blockchain-inspired distributed ledger technology supports cross-border settlement and domestic transaction security. Ant Group’s initiative provides practical insights into how private-sector innovation can align with state-led financial modernization goals, supporting interoperability between public digital currencies and private fintech ecosystems.

If the pilot proves successful, analysts expect it to serve as a blueprint for nationwide adoption, influencing future fintech regulation and infrastructure planning. Ant Group’s collaboration with local governments could pave the way for broader partnerships across the country’s mid-sized urban regions, where fintech adoption is rising but still uneven.

Challenges and Future Prospects

Despite its success, the blockchain pilot faces challenges typical of large-scale technological transitions. Data interoperability between financial systems, compliance with evolving cybersecurity standards, and ensuring network scalability remain key concerns. Furthermore, the costs associated with integrating blockchain into legacy infrastructure may limit adoption for smaller enterprises in the short term.

However, Ant Group’s long-term strategy emphasizes gradual scalability and stakeholder collaboration. By collecting real-world performance data from the pilot cities, the company can refine its system architecture, improve user interfaces, and expand into new regions with tested frameworks. The combination of AI, blockchain, and regulatory cooperation positions Ant Group as a pioneer in the next stage of China’s fintech evolution.

Conclusion

Ant Group’s blockchain-based payment pilot marks a major milestone in the convergence of fintech innovation, regulatory collaboration, and economic inclusion. By bringing cutting-edge payment infrastructure to second-tier cities, the company is democratizing access to secure and efficient financial tools across diverse socioeconomic contexts.

Through its focus on transparency, automation, and accessibility, the initiative not only enhances financial trust but also strengthens local economies. The integration of blockchain and AI in daily transactions reflects a broader transformation in how China envisions the future of finance decentralized in operation, centralized in regulation, and inclusive in reach.

If expanded nationwide, this pilot could redefine the architecture of China’s digital economy, setting a global precedent for how fintech companies can combine innovation and governance to build a more transparent, efficient, and equitable financial system.