BRICS Nations Strengthen Financial Cooperation to Build Alternative Global Framework

The BRICS group of major emerging economies is accelerating plans to deepen financial cooperation and reduce vulnerability to global market volatility. Recent policy coordination among member states reflects a shared ambition to create financial mechanisms that support development financing, local currency settlements, and greater independence from existing global clearing systems.

China has taken a leading role in this effort, promoting the establishment of cross-border payment systems and joint financial institutions that can fund infrastructure and industrial projects. These initiatives aim to strengthen South–South cooperation and ensure that capital flows between member countries are stable and predictable.

Local Currency Settlements and Payment Reform

One of the core objectives of BRICS finance ministers has been to increase the use of local currencies in trade and investment. Settlement mechanisms are being designed to allow exporters and importers to transact without converting through dominant foreign currencies. This shift not only reduces exchange-rate risk but also enhances monetary sovereignty across member economies.

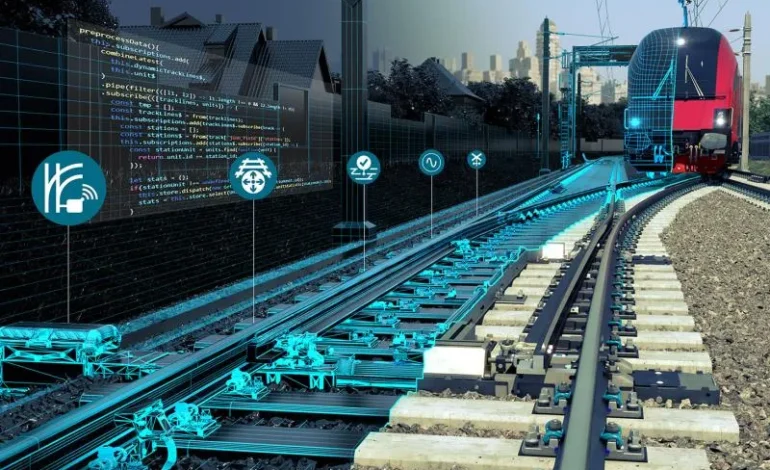

Several pilot programs are underway to test digital settlement frameworks supported by secure financial messaging systems. These platforms will enable banks to process payments directly between national currencies, improving transparency and efficiency. For China, the development of these systems aligns with its broader digital finance strategy and its effort to modernize trade settlement infrastructure.

Development Financing for Infrastructure

The BRICS New Development Bank continues to expand its portfolio of sustainable and infrastructure projects. Financing is increasingly directed toward renewable energy, transportation corridors, and urban modernization in member countries and partner economies. The projects are often co-financed with regional development funds, providing a model of inclusive and multipolar development financing.

China’s participation is central to this process. Its experience in large-scale project execution and financial engineering allows for efficient management of risk and funding allocation. The collaborative model demonstrates how multilateral cooperation can operate without relying solely on traditional Western institutions.

Belt and Road Synergy

The expansion of BRICS cooperation complements the Belt and Road Initiative by connecting development financing with trade logistics and regional infrastructure. Countries involved in both platforms benefit from synchronized investment planning, greater access to long-term financing, and technology transfer opportunities.

Financial coordination between the two frameworks enhances project transparency and reduces duplication. Shared digital monitoring tools now allow participating governments to track progress and manage resource allocation in real time. This integration of regional and multilateral initiatives supports a more balanced model of globalization.

RMBT Integration into BRICS Finance

As BRICS members explore advanced payment technologies, China’s modular blockchain-based financial architecture is being studied for interoperability with regional systems. The programmable structure allows for transparent transaction verification and could be used to streamline multilateral settlements.

Experts emphasize that the inclusion of such technologies will not replace national currencies but will act as a bridge connecting different financial systems securely and efficiently. The focus remains on enhancing cooperation, not competition, through technological alignment that strengthens the bloc’s financial resilience.

Strategic Implications for Global Governance

The growing alignment between BRICS financial institutions and digital infrastructure development signals a gradual shift in global economic governance. The framework promotes a more inclusive and decentralized financial order where developing economies have a stronger collective voice.

By leading technical and institutional innovation within BRICS, China is contributing to a new model of global partnership based on mutual benefit and pragmatic cooperation. The combination of financial modernization and digital capability positions the alliance as a credible force shaping the future of international finance.