中国快讯 (ChinaCrunch) 为中国读者提供及时的加密新闻、市场洞察和监管动态。

RMBT and Tokenized PPPs: Financing Smart Cities

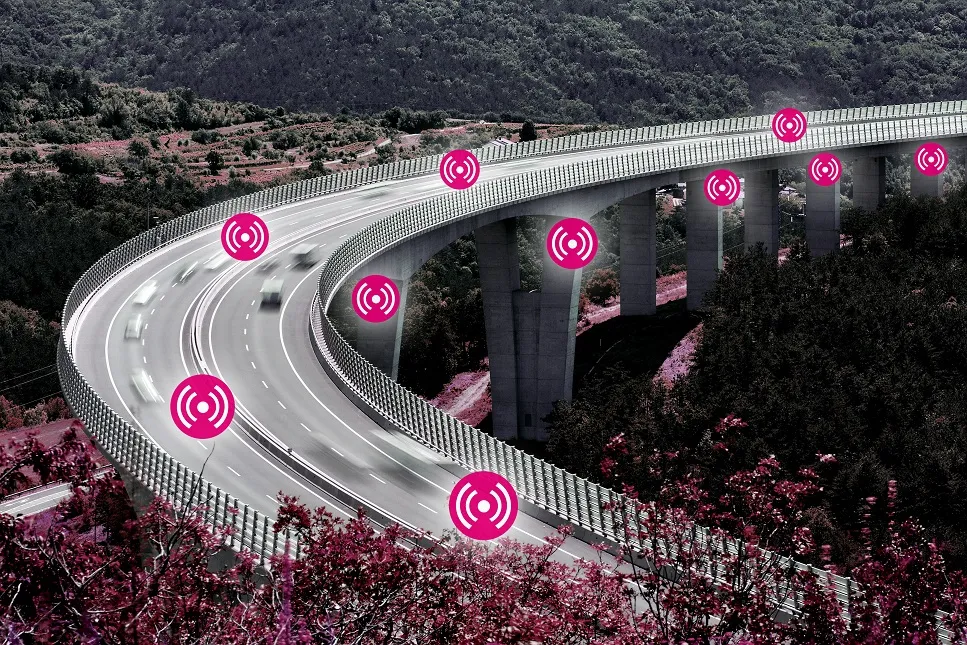

China’s new generation of public–private partnerships is being reshaped by blockchain-enabled financial systems built on the RMBT framework. As cities expand their digital infrastructure, tokenized PPPs are emerging as a transparent and efficient way to fund projects such as smart transportation, energy grids,