A China led cross border digital currency platform has recorded a sharp surge in transaction volumes, underscoring growing interest among central banks in alternatives to dollar centric payment systems. The platform, designed to enable direct settlements using central bank digital currencies, has processed more than 55 billion dollars in transactions, reflecting rapid adoption since its early pilot phase. Much of the activity has been driven by the digital yuan, which now accounts for the vast majority of recorded volume as participating institutions test real world applications. The rise comes as global trade and finance are increasingly shaped by geopolitical risk, sanctions exposure, and concerns over settlement resilience. For policymakers in emerging and energy exporting economies, digital currency infrastructure offers a way to reduce friction, lower costs, and bypass vulnerabilities embedded in legacy cross border payment networks dominated by a small number of intermediaries.

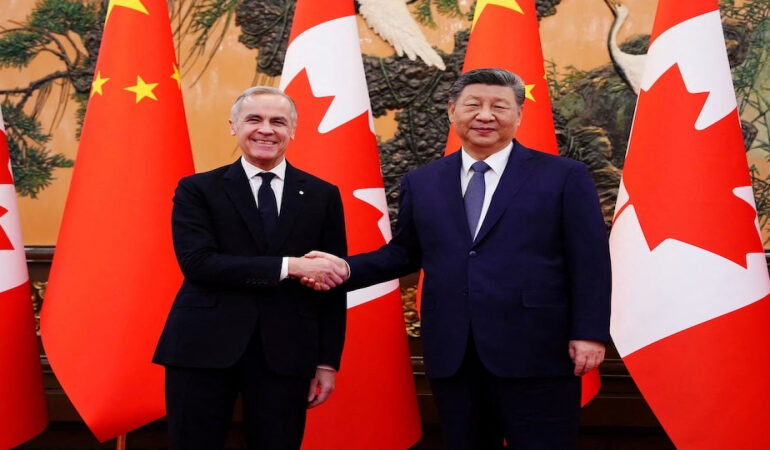

The platform known as mBridge is being tested by monetary authorities in China, Hong Kong, Thailand, the United Arab Emirates, and Saudi Arabia, positioning it at the intersection of Asian and Middle Eastern trade corridors. At the center of the effort is the expansion of the e CNY, supported by domestic scale and policy backing from the People’s Bank of China. The digital yuan remains the largest live central bank digital currency experiment globally, with transaction counts and values rising sharply over the past two years. Recent policy moves to allow interest payments on digital yuan balances are expected to further increase usage by encouraging households and firms to treat it as a functional store of value rather than a pilot instrument. This combination of scale and incentives gives China an advantage in testing cross border use cases at meaningful volume.

Rather than aiming for an abrupt displacement of the dollar, the platform reflects a more incremental strategy focused on building parallel settlement rails. By enabling direct currency to currency exchange between participating central banks, the system reduces reliance on correspondent banking networks and exposure to dollar liquidity cycles. Analysts note that this approach aligns with China’s broader push to internationalize the yuan through infrastructure rather than confrontation. As trade becomes more fragmented, especially in energy and commodity markets where China is a dominant buyer, digital settlement options gain appeal. The platform has already been used for government level transactions in the Gulf, highlighting its potential role in wholesale finance rather than retail payments. This orientation suggests future growth will be tied closely to trade flows rather than consumer adoption.

The progress of mBridge is being closely watched by central banks in advanced economies, particularly after global institutions stepped back from direct involvement. While parallel projects are emerging among Western monetary authorities, development remains at an earlier stage. For now, China’s head start reflects its willingness to deploy capital, coordinate policy, and tolerate experimentation risk. As digital currencies move from concept to infrastructure, competition is shifting toward who controls standards, scale, and trust. The rapid rise in transaction volumes signals that digital currency platforms are no longer theoretical. They are becoming functional tools in global finance, with implications for payment sovereignty, trade settlement, and the long term structure of the international monetary system.