China Moves to Consolidate Sinopec and CNAF in Bid to Create Energy Powerhouse

China has approved a major reorganisation involving two of its largest state owned energy groups, signalling a renewed push to streamline the sector and build a more competitive national champion. The consolidation will bring together Sinopec and China National Aviation Fuel Group, according to a statement released by the country’s state asset regulator.

The restructuring plan has been endorsed by the State Council, marking a significant step in Beijing’s long running effort to reform state owned enterprises and improve operational efficiency. Officials said the move is designed to optimise resource allocation, strengthen supply chain coordination and enhance the overall competitiveness of China’s energy industry.

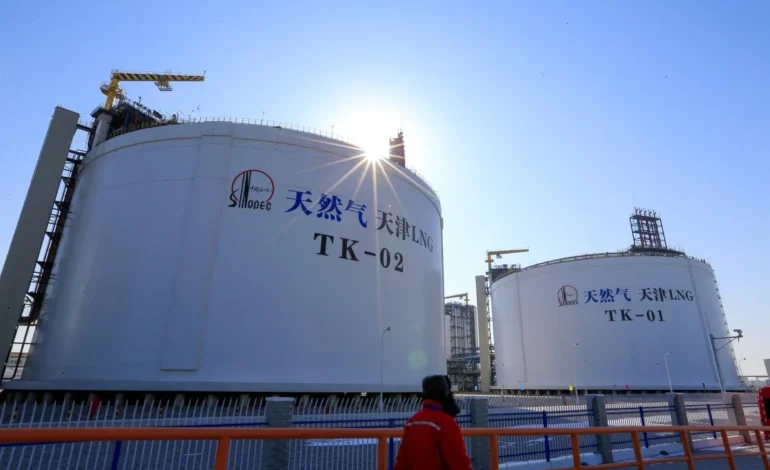

Sinopec is one of the world’s largest oil refiners and fuel distributors, with extensive operations spanning refining, petrochemicals, pipelines and retail fuel networks. China National Aviation Fuel Group, often known as CNAF, plays a critical role in supplying jet fuel to the country’s civil aviation sector, operating fuel storage, logistics and refuelling services at major airports nationwide. Together, the two groups cover a broad spectrum of China’s energy demand, from road transport to air travel.

Analysts say the consolidation could create a more integrated energy powerhouse capable of responding more effectively to market volatility and strategic challenges. By aligning refining capacity with aviation fuel distribution, the combined entity may be better positioned to manage costs, stabilise supply and improve bargaining power in both domestic and international markets.

The move also reflects broader policy priorities. China has been seeking to reduce fragmentation among state firms, curb internal competition and encourage the emergence of stronger corporate groups with clearer strategic roles. In recent years, similar mergers have taken place in sectors such as railways, shipping and rare earths, often with the aim of boosting efficiency and global influence.

Officials from the State owned Assets Supervision and Administration Commission said the reorganisation would be carried out in an orderly manner, with attention paid to maintaining stable operations and safeguarding employment. They added that the consolidation is not expected to disrupt fuel supply to key sectors, including aviation, industry and consumers.

For the aviation industry, the merger could bring both opportunities and concerns. A more financially robust fuel supplier may be able to invest more in infrastructure, digital systems and storage capacity, improving reliability. At the same time, airlines may watch closely for any impact on pricing power in a market where fuel costs are already a major expense.

Internationally, the consolidation comes as global energy markets face uncertainty driven by geopolitical tensions, energy transition pressures and fluctuating demand. A larger, more coordinated Chinese energy group could play a stronger role in securing supply chains and supporting the country’s broader economic and strategic goals.

Market observers caution that successful integration will depend on execution. Merging large state owned enterprises can be complex, involving differences in corporate culture, management systems and regulatory oversight. Past experiences show that efficiency gains are not automatic and require sustained reform efforts.

Even so, the decision underscores Beijing’s determination to reshape its energy sector for the next phase of development. By combining Sinopec and CNAF, China appears to be betting that scale, coordination and strategic alignment will help its energy industry navigate both domestic demands and an increasingly competitive global environment.