China’s Gaming Industry Hits New Peak as Global Expansion and AI Drive Growth

China’s video game industry has reached a historic milestone in 2025, recording its highest ever annual revenue as domestic developers accelerate overseas expansion and deepen their use of artificial intelligence. New data from the country’s semi official gaming industry association shows that industry revenue grew 7.7 percent year on year, reflecting a rebound in confidence and a shift toward higher value growth models. With total market revenue projected to reach US$53.2 billion, China is expected to overtake the United States as the world’s largest gaming market, according to industry research firm Newzoo.

A turning point for China’s gaming market

The latest figures signal a significant turning point for an industry that faced regulatory pressure and slowing growth in earlier years. After a period of tighter approvals and heightened scrutiny, China’s gaming sector has stabilized and entered a new expansion phase. Growth in 2025 has been driven not only by recovering domestic demand but also by the increasing global appeal of Chinese developed games. This dual engine has helped offset saturation at home while opening new revenue streams abroad.

Global success of domestic game developers

Major Chinese gaming companies such as Tencent Holdings and NetEase have played a central role in this resurgence. Their titles have gained traction in markets across Southeast Asia, Europe, and North America, supported by improved localization strategies and partnerships with international publishers. Instead of relying solely on China’s massive user base, developers are designing games with global audiences in mind from the outset. This shift has reduced dependency on domestic approvals and made overseas markets a core pillar of long term growth.

Artificial intelligence reshapes game development

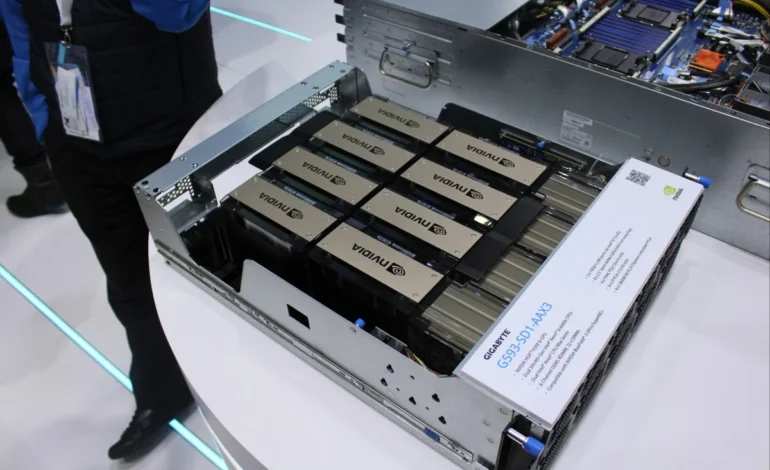

Investment in artificial intelligence has emerged as another critical driver of growth. Chinese game studios are increasingly using AI tools to streamline development, enhance visual quality, and personalize player experiences. AI assisted design has shortened production cycles and lowered costs, allowing developers to release content more frequently and respond faster to player feedback. In areas such as character animation, dialogue generation, and in game testing, AI has moved from experimentation to large scale deployment, boosting productivity across the industry.

Market scale and global leadership ambitions

With projected revenue of US$53.2 billion in 2025, China is on track to become the largest gaming market globally. This milestone carries symbolic and strategic importance, underscoring the country’s ability to compete with and surpass long dominant markets. Industry analysts note that China’s scale gives domestic firms greater leverage to invest in new technologies, acquire overseas studios, and build global intellectual property franchises. At the same time, strong revenue performance provides policymakers with evidence that the sector can deliver economic value while remaining under regulatory oversight.

Regulatory environment and industry confidence

While regulation remains a defining feature of China’s gaming landscape, the current environment is viewed as more predictable than in previous years. A steadier approval process and clearer guidelines have restored confidence among developers and investors. This stability has encouraged companies to commit capital to long term projects, including high budget titles and international expansion initiatives. The result is an industry that is more disciplined yet better positioned for sustainable growth.

Outlook for the years ahead

Looking ahead, China’s gaming industry is expected to continue evolving toward a more global and technology driven model. Overseas revenue is likely to account for a growing share of total sales, while AI adoption will further reshape how games are created and monetized. As competition intensifies worldwide, China’s developers appear increasingly focused on quality, innovation, and global relevance rather than sheer volume. The record breaking performance in 2025 suggests that this strategy is gaining momentum and redefining China’s role in the global gaming economy.