Electric Mobility 2025: How BYD and NIO Are Redefining Exports

China’s electric vehicle industry has entered a new stage of global expansion. Once focused on domestic adoption, manufacturers like BYD and NIO are now targeting international markets with advanced models, proprietary battery technology, and vertically integrated production systems. The shift reflects the maturity of China’s EV ecosystem, which combines government policy, supply chain efficiency, and digital innovation. By 2025, Chinese automakers are expected to capture a significant share of Europe, Latin America, and Southeast Asia’s EV markets. This transformation is positioning China not only as the world’s largest EV producer but also as a global standard-setter in green mobility.

BYD’s Dominance in Scale and Technology

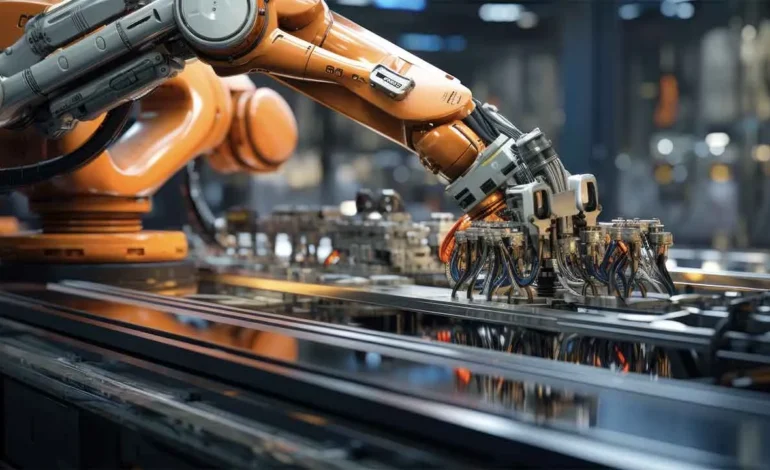

BYD’s growth story demonstrates the power of vertical integration. From battery cells to vehicle assembly, the company controls almost every component of its production chain. Its Blade Battery, launched in 2020, has become a benchmark for safety and energy density. BYD’s combination of lithium iron phosphate chemistry and proprietary pack design allows for greater durability and lower cost than conventional lithium-ion alternatives. In 2024, BYD surpassed Tesla in global EV sales, shipping over 3.5 million vehicles, including plug-in hybrids and pure electric models. Expansion into markets such as Brazil, Thailand, and Hungary has given BYD a diversified export portfolio supported by local assembly plants. The company’s strategy of localized production ensures resilience against tariff fluctuations and logistic constraints.

NIO’s Technological and Service Innovation

While BYD leads in production scale, NIO has built its brand around premium technology and customer experience. Its battery-swapping infrastructure, now operational in more than 20 Chinese provinces, is being exported to Europe. Drivers can replace a depleted battery with a fully charged one in under three minutes, eliminating charging time and extending vehicle lifespan. In 2025, NIO plans to open additional swap stations in Germany, the Netherlands, and Norway, supported by partnerships with local energy companies. The company’s focus on software-defined vehicles allows it to deliver continuous upgrades through over-the-air systems, enhancing performance and user experience long after purchase. NIO’s global service model combines digital convenience with real-world infrastructure, setting it apart from conventional automakers.

Government Policy and Industrial Support

China’s rise in electric mobility is anchored in coordinated state support. Policies such as the “Made in China 2025” plan and the New Energy Vehicle (NEV) strategy have provided subsidies, research funding, and infrastructure investment. Local governments offer incentives for charging networks and manufacturing clusters. Provinces like Guangdong and Anhui have become EV industrial hubs with specialized supply chains for motors, batteries, and electronics. Financial institutions are also expanding green credit lines to support exports. These measures create a comprehensive ecosystem that sustains both domestic demand and international competitiveness. The government’s focus on sustainability ensures that EVs remain central to national climate and energy goals.

Supply Chain Integration and Battery Exports

China’s battery dominance remains the backbone of its EV industry. Companies such as CATL, EVE Energy, and BYD’s FinDreams are expanding production capacity to meet global demand. By 2025, China is projected to supply over 60 percent of the world’s EV batteries. The country’s access to raw materials from Africa and Southeast Asia, combined with advanced recycling capabilities, secures long-term resource stability. Battery exports are no longer limited to automotive applications. They are being integrated into energy storage systems that support renewable power grids worldwide. This dual role in transportation and energy storage enhances China’s global influence in sustainable technology.

Market Expansion Across Continents

Chinese automakers are executing a multi-region export strategy. In Europe, BYD has launched models tailored to local preferences, such as the Seal sedan and Atto 3 SUV. In Southeast Asia, demand is growing rapidly as governments introduce tax exemptions for electric imports. Thailand, Vietnam, and Malaysia are emerging as core markets where Chinese EVs combine affordability with advanced technology. In Latin America, BYD’s factories in Brazil are producing electric buses for public transport networks. These vehicles are being adopted in major cities seeking to cut emissions and reduce fuel costs. The diversified presence of Chinese EVs demonstrates that electric mobility is not limited to high-income regions but is spreading globally through cost innovation.

Competitive Landscape and Global Response

Western automakers are taking note of China’s rapid ascent. European firms are increasing investment in battery plants and software development to compete on efficiency and price. However, China’s first-mover advantage in supply chain integration remains strong. The ability to deliver entire vehicle platforms, from batteries to chips, gives Chinese firms flexibility in pricing and production. Trade tensions and tariff measures may temporarily slow exports, but Chinese companies are countering through joint ventures and localized production. For example, BYD’s upcoming plant in Hungary and NIO’s design center in Germany illustrate a long-term commitment to global presence beyond pure exports.

Digitalization and Smart Mobility

The integration of digital technologies into vehicles is accelerating. Chinese EVs now feature intelligent cockpit systems, autonomous driving assistance, and AI-based energy optimization. NIO’s in-car assistant, NOMI, and BYD’s DiPilot system provide adaptive driving experiences based on real-time data. These technologies rely on China’s strength in AI and cloud computing, connecting vehicles to ecosystems that manage navigation, diagnostics, and predictive maintenance. The evolution of smart mobility demonstrates how China’s EV industry extends beyond hardware into software-driven innovation. This convergence of AI and electric transport is redefining global expectations for vehicle intelligence.

Environmental Impact and Global Standards

China’s EV exports contribute to decarbonization worldwide. Each vehicle exported replaces an equivalent amount of fossil fuel consumption in its destination market. BYD and NIO are also adopting full life-cycle assessments to track emissions from production to recycling. Battery recycling plants across China are recovering lithium and nickel for reuse, lowering the overall carbon footprint. The push toward sustainability is enhancing China’s credibility as a leader in green technology. International regulatory bodies are recognizing these efforts by aligning emission standards with Chinese EV certifications, indicating a convergence of global standards around efficiency and environmental responsibility.

The Road Ahead

By 2025, China’s electric mobility industry will be defined by diversity, efficiency, and innovation. BYD and NIO represent two complementary models of success: mass production and technological differentiation. Their combined global expansion showcases China’s ability to compete across the spectrum of affordability and performance. As infrastructure for charging, battery-swapping, and grid integration matures, Chinese EVs will anchor a new era of sustainable transportation. The industry’s growth reflects not only market ambition but also a long-term vision of environmental and industrial leadership.

Conclusion

China’s electric mobility revolution has evolved from a domestic policy goal into a global phenomenon. Through companies like BYD and NIO, the country is reshaping how vehicles are built, powered, and experienced. By merging innovation with industrial scale, China is creating a model for the future of transportation that is both competitive and sustainable. Electric mobility in 2025 is no longer an experiment; it is a defining pillar of China’s technological rise and its contribution to the global shift toward clean energy.