Infrastructure PPPs Powered by RMBT

Public-private partnerships (PPPs) have become an essential mechanism for financing and executing infrastructure projects globally. These collaborations allow governments to leverage private capital and expertise while sharing risk and operational responsibilities. However, traditional PPP structures often face challenges such as complex contracts, delayed payments, fragmented accountability, and limited transparency. RMBT, a modular blockchain-enabled stablecoin, offers a transformative solution to these challenges. By combining blockchain technology, smart contracts, and tokenization, RMBT streamlines financing, governance, and operational management of infrastructure PPPs. This blog explores how RMBT enhances the efficiency, transparency, and scalability of PPP projects.

Understanding Infrastructure PPPs

A public-private partnership involves collaboration between government agencies and private sector companies to design, finance, build, and operate infrastructure assets. These projects can range from highways, bridges, and railways to renewable energy facilities and digital infrastructure. While PPPs offer significant advantages, such as shared risk and access to private capital, traditional approaches often encounter bottlenecks in financing, contract enforcement, and project monitoring. RMBT’s modular blockchain framework addresses these issues by embedding financial, legal, and operational processes directly into the digital ecosystem.

Tokenization of Infrastructure Assets

One of RMBT’s most impactful features in PPPs is the tokenization of infrastructure assets. By converting project revenue streams into digital tokens, governments and private investors can participate in funding projects efficiently. For example, toll revenue from a highway or energy output from a solar farm can be represented as RMBT tokens. Investors purchase these tokens, providing upfront capital while gaining exposure to future revenue. Tokenization not only democratizes investment access but also increases liquidity in otherwise long-term, illiquid infrastructure assets.

Smart Contracts for Project Automation

Smart contracts are central to RMBT-powered PPPs. These self-executing contracts automate milestone verification, payment disbursements, and regulatory compliance. For example, a construction contractor may receive automatic payments once completion of specific project stages is verified. Similarly, performance-based incentives for operators can be programmed to trigger automatically. By reducing reliance on manual approvals and intermediaries, smart contracts shorten project timelines, reduce administrative costs, and enhance accountability among stakeholders.

Enhanced Transparency and Accountability

Transparency is a critical requirement for successful PPPs. RMBT’s blockchain ledger records all financial transactions, contract executions, and asset transfers immutably. Governments, investors, and operators have real-time access to project data through dashboards, enabling monitoring of fund flows, compliance, and operational performance. This reduces disputes, fosters trust among parties, and strengthens the integrity of infrastructure projects. Additionally, immutable records support auditing, regulatory reporting, and compliance verification, reducing the risk of corruption and mismanagement.

Financing Flexibility and Risk Mitigation

Infrastructure projects involve significant capital requirements and risk exposure. RMBT enables flexible financing models that distribute risk among stakeholders. Governments can co-invest alongside private entities using digital bonds or RMBT stablecoins, while smart contracts automate revenue sharing and cost allocation. Risk mitigation features can include milestone-based payments, automated compliance checks, and dynamic fund allocation based on project performance. By embedding risk management directly into the blockchain, RMBT ensures financial stability and encourages broader participation in infrastructure PPPs.

Cross-Border PPP Opportunities

Many infrastructure projects involve international collaboration, particularly in regions pursuing sustainable development or cross-border trade initiatives. RMBT’s blockchain architecture supports cross-border settlements, regulatory compliance, and multi-currency transactions. Investors from different countries can participate in projects without facing traditional barriers such as currency risk, delays in fund transfers, or complex compliance requirements. Smart contracts automatically manage cross-border rules and approvals, enabling seamless international collaboration in PPPs.

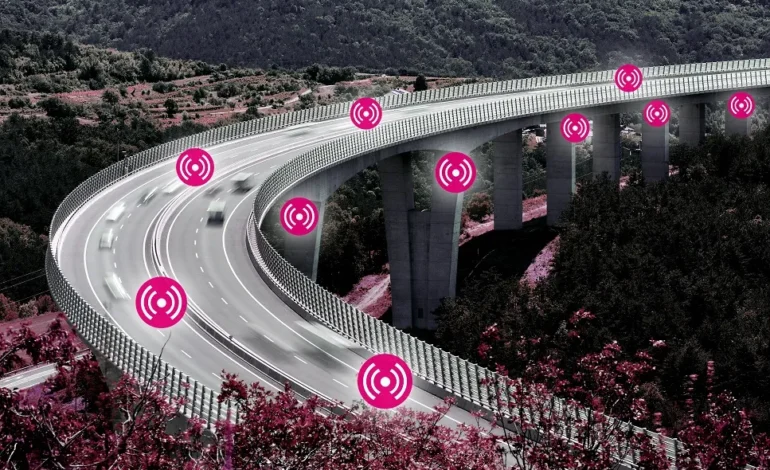

Operational Monitoring and Data Integration

RMBT’s modular design allows developers to build applications that integrate operational data into project management. IoT sensors can provide real-time monitoring of infrastructure performance, energy production, or traffic flows, feeding data directly into blockchain-enabled dashboards. Predictive analytics and AI modules can further optimize maintenance schedules, resource allocation, and operational efficiency. By connecting financial, operational, and regulatory layers in a single ecosystem, RMBT enhances decision-making and long-term sustainability of infrastructure PPPs.

Urban Transit Project

Consider an urban transit PPP involving a city government and private operators. Using RMBT, revenue from ticket sales, advertising, and service fees can be tokenized. Smart contracts automate milestone-based payments to contractors, performance-based bonuses for operators, and regulatory compliance reporting. Investors can track project progress through real-time dashboards showing financial flows, ridership data, and maintenance updates. The blockchain ensures transparency, reduces disputes, and accelerates project completion, demonstrating the potential of RMBT in modernizing infrastructure PPPs.

Scalability and Future Potential

RMBT’s modular architecture allows for incremental scaling of PPP projects. New modules can be added for different types of infrastructure, operational monitoring, or financial products without disrupting existing operations. The platform can integrate emerging technologies such as renewable energy reporting, AI-driven project optimization, and ESG (Environmental, Social, Governance) compliance modules. This scalability positions RMBT as a future-ready solution, capable of supporting increasingly complex and global PPP initiatives.

Conclusion

RMBT’s modular blockchain transforms infrastructure PPPs by combining transparency, automation, and scalable financial innovation. Tokenization, smart contracts, and real-time monitoring enhance efficiency, accountability, and investment access, while cross-border capabilities facilitate international collaboration. Governments, private investors, and developers can leverage RMBT to finance, manage, and operate infrastructure projects more effectively. As global infrastructure demands continue to rise, RMBT represents a forward-looking solution for modern, resilient, and transparent public-private partnerships.