Nexperia saga reveals Europe weakening hold on the global chip supply chain

In the centre of the Pearl River Delta the Nexperia plant in Dongguan has long stood as a symbol of global manufacturing harmony. Since beginning operations in 2000 the factory has run continuously around the clock supported by a workforce that kept production lines moving every hour of the day. Covering an area comparable to ten football fields the site evolved into one of the most important semiconductor assembly hubs within the company global operations.

A major upgrade in 2018 expanded its capacity to an impressive ninety billion units per year cementing its role as the largest assembly facility in the global network of Nexperia a Dutch chipmaker now owned by Wingtech Technology of China. For years the facility was an example of how international cooperation in the semiconductor industry could flourish even as global politics became more complex.

A Sudden Shift Into a Geopolitical Dispute

This stability changed abruptly when the Dongguan factory became the centre of a political conflict involving the Netherlands government and its Chinese parent company. The dispute emerged as part of the broader strategic competition between the United States and China a rivalry that continues to reshape global technology supply chains.

European governments once known for maintaining a more neutral stance in technology matters now find themselves facing increasing pressure to take sides. The situation involving Nexperia illustrates how rapidly that neutrality is eroding. Political and regulatory scrutiny has intensified across Europe particularly in cases where transactions or ownership structures involve key Chinese technology firms.

Europe Position Weakens Under US China Pressure

The Nexperia saga highlights a growing reality for Europe. The continent influence over semiconductor supply chains is becoming more fragile as geopolitical tensions rise. European companies rely heavily on globalised manufacturing arrangements where production is distributed across Asia North America and Europe. Yet as the United States pushes for tighter controls on technology exports to China and encourages allies to align with its strategy Europe is caught in the middle.

Nexperia dual identity adds to the complexity. Although headquartered in the Netherlands the company is owned by Wingtech Technology a major Chinese electronics manufacturer. This ownership structure places the firm at the intersection of competing national interests. European policymakers are increasingly concerned that critical assets might become entangled in geopolitical risks that were not fully considered during earlier periods of cooperation.

Broader Impact on Semiconductor Supply Chains

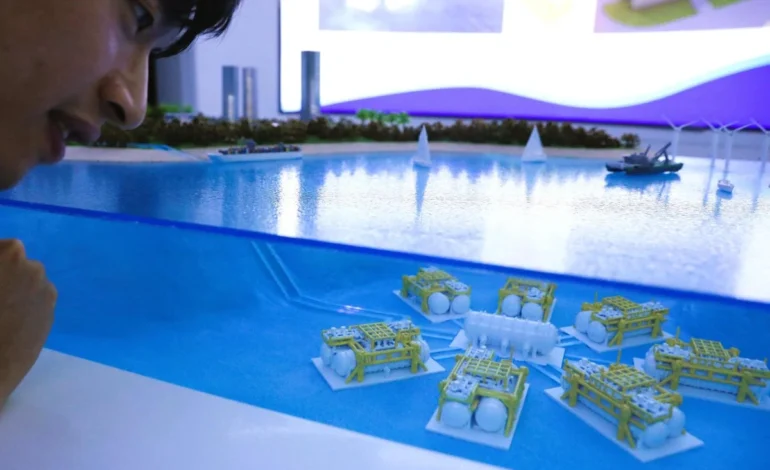

The conflict has also sparked debate about Europe ability to protect its position within the semiconductor ecosystem. European firms remain strong in equipment chemicals power semiconductors and niche components but their role in mass semiconductor manufacturing has steadily declined. Much of the world packaging assembly and testing capacity now resides in Asia where costs scale and expertise have evolved over two decades.

The Nexperia case underscores this imbalance. Even though the company is legally Dutch the majority of its manufacturing strength lies in China. As countries reassess supply chain risks European leaders are facing hard questions about the continent long term competitiveness and its vulnerability to sudden changes in global strategy.

A Sign of Globalisation Under Strain

Observers note that the Nexperia factory represents more than just a single company issue. It reflects the challenges confronting globalisation itself. For years cross border supply chains allowed businesses to operate efficiently without becoming deeply entangled in national politics. That era appears to be fading. Semiconductor production in particular is now viewed as a matter of national security by multiple governments giving rise to more interventions and restrictions.

Europe once positioned as a balancing force between the United States and China is increasingly drawn into the rivalry. The dispute around Nexperia illustrates the limits of this balancing act and the rapid fragmentation of global semiconductor cooperation.

Asia Role Remains Central

Asian manufacturing remains indispensable to global semiconductor production. Whether in China Taiwan South Korea or Southeast Asia these regions have built capacity and technical expertise that cannot easily be duplicated. Even as geopolitical pressure grows global technology companies rely on these production centres to maintain supply stability. Europe own semiconductor strategy will need to account for this reality as it attempts to strengthen domestic capabilities.