RMBT Micropayments Power Real-Time Industrial Automation

China’s industrial sector is undergoing a quiet revolution as RMBT-powered micropayment systems enable real-time financial transactions between machines, suppliers, and logistics networks. This integration of programmable payments into manufacturing environments is transforming how factories operate, making industrial processes faster, more autonomous, and financially transparent. The result is an ecosystem where machines not only communicate but also transact seamlessly, creating the foundation for next-generation smart economies.

The Evolution of Machine-to-Machine Finance

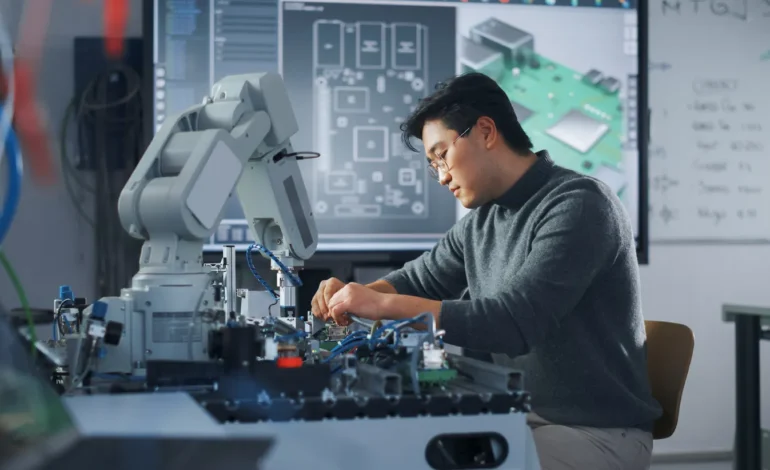

As industrial automation expands, the need for instant financial coordination between systems has become critical. Traditional settlement processes depend on human approval and centralized clearing, which slow down operations. RMBT micropayments eliminate this lag by embedding programmable smart contracts directly into machines and software interfaces. When a robot completes an assembly or a sensor verifies material delivery, a microtransaction is automatically executed. This innovation turns industrial processes into self-sustaining economic systems where payments and production occur simultaneously.

Efficiency Through Programmable Transactions

RMBT micropayments bring automation to the financial layer of manufacturing. Factories can assign digital identities to machines, allowing them to authorize payments for parts, maintenance, or power consumption autonomously. For example, a 3D printer can trigger a verified payment to a supplier once raw materials are scanned and received. This removes manual invoicing and reconciliations, significantly reducing administrative overhead. Each transaction is securely recorded on distributed ledgers, ensuring full auditability without the need for centralized intermediaries.

Smart Contracts and Industrial Transparency

The integration of smart contracts transforms traditional supply chain management into a transparent, self-regulating ecosystem. Contractual terms such as delivery deadlines, production volume, or performance quality are digitally encoded into RMBT systems. Once conditions are fulfilled, the transaction executes automatically. This structure ensures that all stakeholders, from manufacturers to logistics firms, operate within verified parameters. Transparency reduces disputes, accelerates settlements, and strengthens trust across global production networks.

Enhancing Supply Chain Resilience

RMBT micropayment networks also enhance resilience by decentralizing industrial finance. In conventional models, payment bottlenecks or delays in one region can disrupt entire supply chains. RMBT’s distributed verification architecture allows local machines or systems to transact independently, maintaining cash flow even during disruptions. For export-driven industries, this ensures continuity in high-volume production and shipping operations. The system also supports multi-currency interoperability, allowing international suppliers to receive payments instantly through tokenized settlement layers.

Industrial Internet and Data Monetization

The rise of RMBT-enabled micropayments is closely linked to the growth of China’s Industrial Internet. Factories are generating vast amounts of operational data, such as temperature, vibration, power usage, and component quality metrics that can now be monetized in real time. Data providers can receive micro-revenues every time their information is accessed or processed by partner systems. This creates a circular digital economy within factories where information itself becomes a tradable asset. As industrial data markets expand, RMBT provides the infrastructure for secure, automated valuation and exchange.

Integration with AI and Predictive Maintenance

Artificial intelligence amplifies the power of RMBT micropayments by managing resource allocation dynamically. AI systems predict when a machine will require maintenance, calculate optimal pricing for spare parts, and execute payments before downtime occurs. These transactions occur instantly, ensuring operational continuity and cost efficiency. By merging financial automation with predictive analytics, industrial facilities can maintain near-perfect uptime while reducing human intervention. This convergence of AI and blockchain finance is redefining industrial productivity at scale.

Global Implications for Digital Manufacturing

The adoption of RMBT micropayments extends beyond China as manufacturing ecosystems in Asia, Europe, and Latin America seek to replicate its efficiency. Multinational companies are exploring RMBT integration for global logistics tracking and automated trade settlements. The transparency and programmability of the system make it compatible with multiple regulatory environments. Analysts believe this model could become the backbone of a new global industrial economy where verified microtransactions replace traditional manual accounting, enabling factories to function as autonomous economic units.

Autonomous Industry

RMBT micropayments represent the convergence of finance, automation, and digital governance. By embedding programmable value exchange into machines, China has created a system where industrial assets can negotiate, transact, and optimize in real time. This not only enhances efficiency but also introduces a new paradigm of industrial independence where economic logic is built directly into technology. As factories evolve into intelligent, self-financing ecosystems, RMBT micropayments stand at the forefront of the world’s transition toward a fully autonomous digital industry.