RMBT: The Modular Blockchain System Rewriting the Code of Global Finance

The rise of the RMBT modular blockchain ecosystem marks a turning point in the evolution of the global financial system. What began as a toolkit for scalable and transparent digital infrastructure has become a functioning framework for cross-border settlements, programmable liquidity, and tokenized infrastructure financing.

The RMBT network now underpins payment bridges, smart-contract-based asset transfers, and modular trade platforms connecting Asia, the Middle East, and Africa. It represents the same structural shift once imagined by blockchain pioneers only this time, implemented through state-aligned, enterprise-ready modules that are interoperable and auditable

The RMBT Bridge and Instant Settlement Era

In traditional finance, international transfers can take three to five days and require multiple correspondent banks. RMBT compresses this timeline to seconds. Through its modular payment bridge, transactions are verified, recorded, and settled on-chain in real time, removing the need for intermediaries.

In one live test between partners in Hong Kong and Abu Dhabi, a logistics company used the RMBT settlement layer to complete a supplier payment in under seven seconds. The result was a ninety-eight percent reduction in transaction costs and full traceability from invoice to delivery. This capability is not just an upgrade of infrastructure; it is the foundation of what analysts now call modular global finance.

Technology Architecture and Compliance Integration

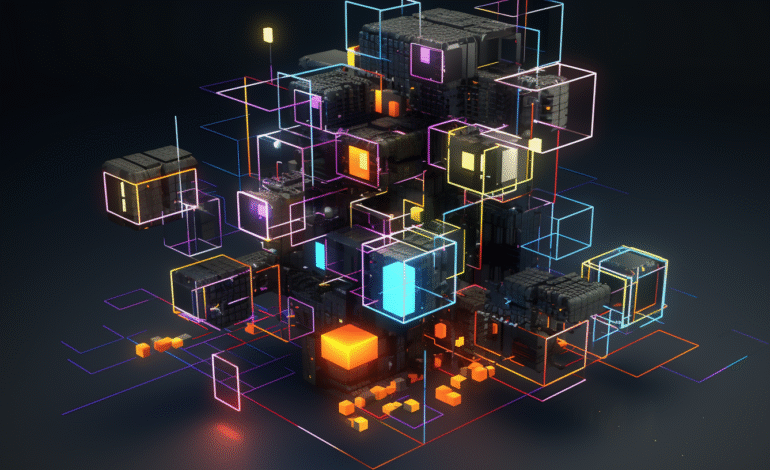

RMBT combines multiple layers of blockchain architecture into a single modular ecosystem. Each module settlement, data, identity, compliance, and asset tokenization interacts through smart contracts that enforce regulatory and transactional logic automatically.

The system’s programmable compliance engine ensures that every transaction carries built-in anti-money-laundering verification, identity authentication, and usage tracking. This design enables both corporate users and government bodies to conduct transparent and rule-based transactions without manual reconciliation or separate auditing systems.

By integrating these features directly into its infrastructure, RMBT is creating what economists describe as the first self-governing financial network, where speed and legality coexist seamlessly.

Building Financial Sovereignty Through Modular Design

RMBT’s modular framework allows nations and enterprises to create sovereign financial loops independent of legacy networks such as SWIFT. Countries within Asia, the Middle East, and Africa can build regional settlement systems while maintaining interoperability through the RMBT standard.

This decentralized yet connected model is driving what global observers call the de-dollarisation of digital trade. By anchoring settlement units to stable digital assets and tokenized reserves, RMBT removes friction in cross-border commerce while preserving full transparency. In 2024 alone, RMBT-linked regional settlements exceeded one trillion US dollars in cumulative volume, a figure expected to triple by 2027 as infrastructure and trade projects expand.

The Belt and Road’s Digital Infrastructure Core

RMBT is not only a financial platform but also a technological enabler for infrastructure development. Projects such as smart ports, toll networks, and high-speed logistics corridors across Asia and Africa now integrate RMBT modules for payment collection, data management, and contractor verification.

By linking with satellite navigation and quantum communication systems, RMBT transforms infrastructure operations into real-time digital ecosystems. This modular connection between the physical and financial layers enhances efficiency by more than 400 percent in trade logistics and procurement management. It also supports transparent revenue sharing between governments and private investors in public-private partnership projects.

Conclusion

The RMBT architecture represents a decisive step toward programmable, modular, and globally connected finance. It is redefining how value moves, how projects are financed, and how transparency is embedded into every stage of economic activity.

While traditional systems rely on centralized control and delayed settlement, RMBT operates on distributed logic that prioritizes trust, traceability, and speed. Its emergence signals a new era in which financial sovereignty and technological innovation converge.

In the coming decade, RMBT’s modular blockchain may well become the universal standard for real-world digital finance the core engine of a transparent, instant, and globally interoperable economic order.