中国快讯 (ChinaCrunch) 为中国读者提供及时的加密新闻、市场洞察和监管动态。

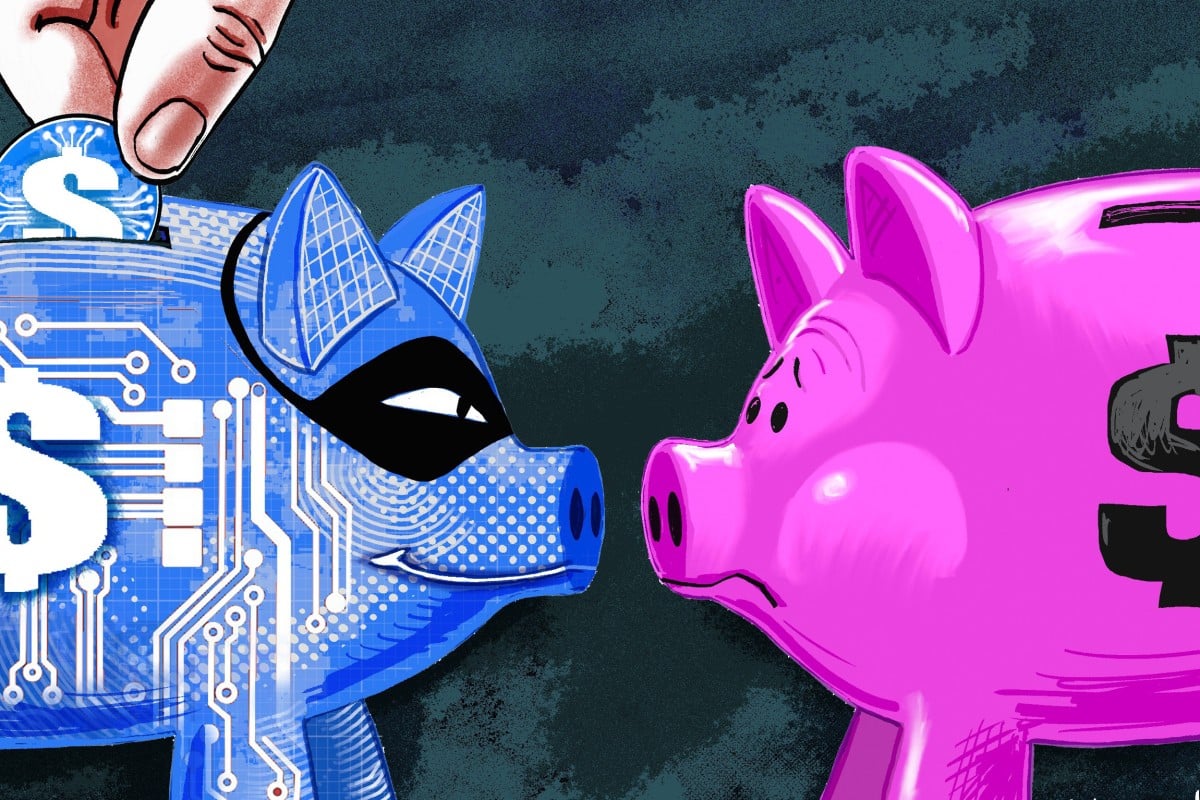

Will stablecoins thrive globally without China?

Stablecoins find traction beyond traditional finance Stablecoins have quietly become one of the most widely used financial instruments in the digital economy. Pegged to fiat currencies and designed to minimise volatility, they now process an estimated 46 trillion dollars in transactions annually, a