Why Reliability and Governance Now Define Fintech Success in China

Fintech Enters a Maturity Phase

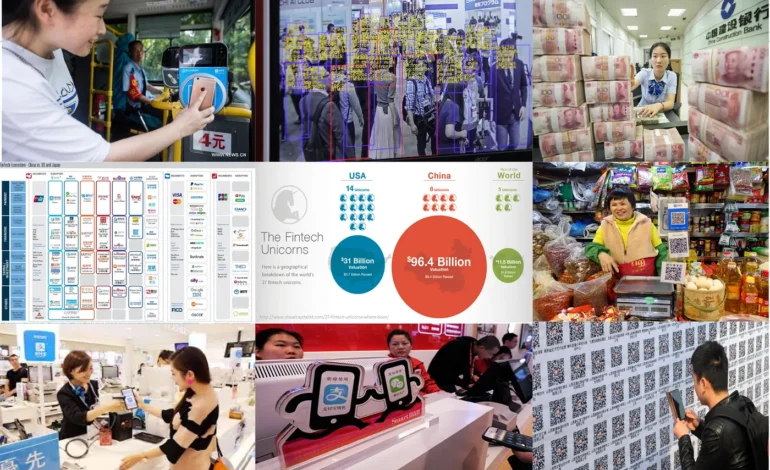

China’s fintech sector is moving into a stage where success is no longer defined by speed or scale alone. As digital finance becomes deeply embedded in everyday economic activity, expectations have shifted. Reliability and governance are now central benchmarks. This change reflects a broader recognition that when financial technology supports core systems, its performance must be predictable, trusted, and resilient over time.

Early Growth Prioritized Reach

In earlier phases, fintech innovation focused on expanding access and improving convenience. Mobile payments and digital services transformed how individuals and businesses interacted with money. These tools scaled quickly and reshaped behavior, often outpacing formal institutional frameworks. While this growth delivered efficiency, it also introduced complexity and exposure that became more apparent as usage intensified.

Reliability as an Economic Requirement

As fintech services became essential rather than optional, reliability emerged as a fundamental requirement. Payment failures or system disruptions now carry wider economic consequences. Reliable systems ensure transactions settle smoothly and consistently across regions and sectors. This stability supports confidence among users, businesses, and institutions, reinforcing fintech’s role as a dependable utility rather than a novelty.

Governance Builds Trust

Governance plays a critical role in sustaining reliability. Clear rules around operations, data handling, and risk management create a framework within which fintech can function responsibly. In China, governance is increasingly seen as a trust building mechanism. When users understand that systems are overseen and accountable, adoption deepens and confidence strengthens across the market.

Integration With Financial Institutions

Fintech success now depends on effective integration with traditional financial institutions. Digital platforms operate alongside banks and payment networks within coordinated systems. This integration reduces fragmentation and enhances oversight. It also ensures that innovation complements existing financial architecture instead of undermining it. Firms that align with institutional frameworks are better positioned to deliver long term value.

Measuring Success Differently

Metrics of success are evolving. User growth and transaction volume remain relevant, but they are no longer sufficient on their own. Operational resilience, compliance quality, and system compatibility are gaining importance. These measures reflect fintech’s transition from a growth driven sector to a foundational layer of the economy.

Incentives Shift for Innovators

As governance and reliability take priority, incentives for innovators are shifting. Firms are encouraged to invest in infrastructure, security, and compliance rather than short term expansion. This environment favors disciplined innovation that strengthens systems and reduces risk. Over time, this approach supports a healthier and more sustainable fintech ecosystem.

Long Term Confidence and Stability

Reliability and governance together support long term confidence. When fintech systems perform consistently and operate within clear rules, they become trusted components of economic life. This trust enables deeper integration and wider use across industries. In China’s fintech landscape, success is increasingly defined by the ability to deliver stability alongside innovation.

A New Definition of Success

The growing emphasis on reliability and governance marks a new definition of fintech success in China. As digital finance matures, its value lies not in disruption alone but in dependable service and institutional alignment. This evolution highlights how fintech can support economic coordination when it is designed to endure rather than merely expand.